How Blockchain and Tokenization are Transforming the Gold Mining Industry

- Introduction to Tokenization in Gold Mines

- Overview of the Gold Mining Industry

- Introduction to Blockchain and Tokenization

- The Concept of Tokenization

- Definition and Basics of Tokenization

- The Role of Blockchain in Tokenization

- Application in the Gold Mining Sector

- Case Studies: Santo Mining Corp and Vegachi Holdings SAS

- Real-world Examples and Current Projects

- Technical Aspects of Tokenizing Gold Mines

- How Gold Mining Rights are Tokenized

- The Use of NFTs and ERC-20 Tokens

- Role of Smart Contracts in Tokenization

- Financial and Legal Considerations

- Transaction Fees and Royalty Structures

- Legal Implications and Regulatory Compliance

- Market Impact and Investor Benefits

- Market Valuation and Growth of Tokenized Gold

- Advantages for Investors: Accessibility, Liquidity, and Fractional Ownership

- Challenges and Risks

- Addressing Security Concerns

- Risks of Scarcity Value and Asset Linkage

- Regulatory Challenges and Future Prospects

- Current Regulatory Landscape

- Future Trends and Potential Developments in Tokenization

- Conclusion

- Summarizing the Potential of Gold Mine Tokenization

- Future Outlook for Blockchain in the Gold Mining Industry

Introduction to Tokenization in Gold Mines

Overview of the Gold Mining Industry

The gold mining industry has long been a cornerstone of economic development and wealth generation. Historically, gold has been sought after for its rarity, beauty, and intrinsic value, serving as a basis for currency, investment, and industrial use. The industry itself is vast, encompassing exploration, extraction, processing, and refining operations across the globe.

Gold mining, however, is not without its challenges. The sector faces issues such as environmental concerns, fluctuating gold prices, and the need for sustainable and responsible mining practices. In addition, the traditional methods of investing in gold mining have been typically accessible only to large investors or those with specific industry knowledge.

Despite these challenges, the industry continues to evolve, adapting to new technologies and market trends. One of the most significant recent developments in this sector is the integration of blockchain technology and the concept of tokenization.

Introduction to Blockchain and Tokenization

Blockchain technology, most commonly known for underpinning cryptocurrencies like Bitcoin, is a decentralized digital ledger that records transactions across many computers. This technology ensures that records cannot be altered retroactively without altering all subsequent blocks, providing a high level of security and transparency.

In the context of the gold mining industry, blockchain introduces a groundbreaking concept: tokenization. Tokenization is the process of converting rights or ownership of tangible assets into digital tokens. These tokens represent a share or stake in the underlying asset and are recorded on the blockchain, ensuring transparency, security, and ease of transfer.

The implications of tokenization for gold mines are profound. It allows for the fractionalization of ownership in gold mining operations, making it possible for smaller investors to participate in the gold market. This approach democratizes investment in gold mining, traditionally the domain of large-scale investors and institutions. Additionally, the use of blockchain technology in tokenization ensures that all transactions are secure, transparent, and immutable.

As we delve deeper into this article, we will explore how tokenization is being applied in the gold mining industry, its benefits, technical aspects, financial and legal considerations, and the challenges and future prospects of this innovative approach.

Stay tuned as we journey into the intersection of traditional gold mining and modern blockchain technology, unlocking new potentials and opportunities for investors and the industry alike.

The Concept of Tokenization

Definition and Basics of Tokenization

Tokenization is the process of converting rights or ownership of real-world assets into digital tokens. These tokens, which exist on a blockchain, represent a stake or share in the underlying physical asset, in this case, gold mines. This innovative approach essentially turns tangible assets into tradable digital securities.

At its core, tokenization involves dividing an asset into shares that can be owned by multiple investors. This process, known as fractional ownership, democratizes access to investment opportunities that were previously available only to a select few due to high entry barriers in terms of capital requirements. In the context of gold mines, tokenization means that investors can own a part of the mining rights or the value derived from gold extraction without the need to invest in the entire operation.

Tokenization transforms the traditional investment landscape by offering increased liquidity, transparency, and accessibility. It simplifies the investment process, reduces transaction costs, and opens up new markets by enabling the trading of digital tokens representing real-world assets.

The Role of Blockchain in Tokenization

Blockchain plays a crucial role in the tokenization of assets. As a decentralized ledger, it records every transaction and ownership change of a digital token, ensuring transparency and immutability. Each transaction on the blockchain is verified and encrypted, making it highly secure and resistant to fraud.

In the gold mining industry, blockchain serves several key functions in the tokenization process:

- Security and Transparency: Blockchain’s inherent security features ensure that the ownership records of the tokenized gold mine assets are tamper-proof. This transparency is crucial for investor trust and regulatory compliance.

- Efficient Transfer of Ownership: The blockchain enables the quick and efficient transfer of tokens between parties. This ease of transfer significantly increases the liquidity of the asset, as tokens can be bought and sold on digital exchanges.

- Smart Contracts: These are self-executing contracts with the terms of the agreement directly written into lines of code. In the case of tokenized gold mines, smart contracts automate the process of dividends, rights distribution, and other operational aspects, further enhancing efficiency and reducing the need for intermediaries.

- Traceability and Provenance: Blockchain technology allows for the tracking of the gold from the mine to the market. This traceability is particularly important for ethical sourcing and compliance with environmental, social, and governance (ESG) standards.

Through blockchain, the tokenization of gold mines not only simplifies investment and trading but also brings a new level of integrity and reliability to the sector. The technology ensures that investors have a clear and indisputable record of their ownership and the asset’s history, which is a game-changer in the traditionally opaque and complex world of gold mining investments.

Application in the Gold Mining Sector

Case Studies: Santo Mining Corp and Vegachi Holdings SAS

A prime example of the application of tokenization in the gold mining sector is the partnership between Santo Mining Corp and Vegachi Holdings SAS. This collaboration serves as a pioneering case study in integrating blockchain and tokenization technologies into the gold mining industry.

Santo Mining Corp, operating as Santo Blockchain Labs, entered into a non-fungible token (NFT) software development agreement with Vegachi Holdings SAS. The aim was to develop a series of NFTs linked to the fractionalization of land with gold mining rights. This project is significant as it merges legal and financial technology with digital assets, thereby linking the traditional legal framework of land and mineral rights with innovative blockchain technology.

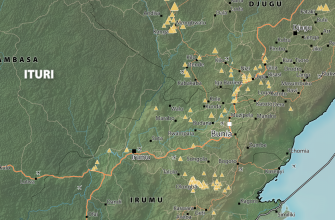

Vegachi Holdings owns a substantial area of land in Vegachí, Antioquia, Colombia, which possesses government-issued gold mining rights. The site has shown promising potential, with geological tests indicating a substantial gold presence. This partnership’s innovative approach allows multiple investors to own a stake in these gold mining rights through the purchase of NFTs.

Under the agreement, Santo Mining Corp receives a percentage of the transaction fee for each NFT sold and a royalty fee for future transactions. This structure not only creates an efficient system for tracking and managing sales but also ensures the permanence and transparency of transaction details on the blockchain.

Real-world Examples and Current Projects

The Santo Mining Corp and Vegachi Holdings SAS partnership is just one of many real-world examples where tokenization is being applied in the gold mining sector. Other projects and initiatives globally are exploring similar applications of blockchain and tokenization in this field.

- Tokenized Gold Products: Various financial institutions and blockchain companies have launched tokenized gold products, allowing investors to buy digital tokens representing physical gold. These products often aim to offer the benefits of physical gold ownership (like value stability) combined with the liquidity and ease of transaction provided by digital assets.

- Blockchain for Ethical Sourcing: Some companies are using blockchain to ensure ethical sourcing in gold mining. By tokenizing gold at the point of extraction and recording its journey on a blockchain, these initiatives provide transparency and traceability, ensuring that the gold is sourced responsibly and ethically.

- Integration with Decentralized Finance (DeFi): Tokenized gold mines and gold-backed digital assets are increasingly being integrated into the broader ecosystem of decentralized finance. This integration allows for innovative financial products, such as gold-backed loans and yield-generating instruments, which leverage the stability of gold as a backing asset.

- Pilot Projects and Government Initiatives: Various governments and regulatory bodies are exploring or facilitating pilot projects to understand the implications of tokenizing natural resources, including gold. These initiatives aim to modernize the sector, improve market efficiencies, and make gold mining investments more accessible and transparent.

Through these applications, the gold mining industry is witnessing a transformative shift. Tokenization is not only opening up new investment avenues but also promoting ethical practices and greater market efficiencies. As these initiatives continue to evolve, they are likely to set precedents for the broader adoption of blockchain and tokenization in the natural resources sector.

Technical Aspects of Tokenizing Gold Mines

How Gold Mining Rights are Tokenized

Tokenizing gold mining rights involves a multi-step process that converts these rights into digital tokens, which can then be traded and owned. This process begins with the identification and verification of the gold mining rights, ensuring they are legally sound and compliant with relevant regulations.

Once the rights are verified, they are divided into fractional shares. This division is crucial in enabling multiple investors to own a part of these rights. The size and value of each fractional share are determined based on the total value of the gold mining rights and the intended number of tokens to be issued.

The next step involves creating digital tokens that represent these fractional shares. Each token corresponds to a specific part of the gold mining rights, and its ownership is recorded on a blockchain. This recording not only establishes ownership but also ensures transparency and security, as the blockchain ledger is immutable and publicly verifiable.

The Use of NFTs and ERC-20 Tokens

In the context of tokenizing gold mines, two types of tokens are primarily used: Non-Fungible Tokens (NFTs) and ERC-20 tokens.

- Non-Fungible Tokens (NFTs): NFTs are unique and cannot be exchanged on a one-to-one basis with other tokens. In the case of gold mining rights, NFTs can represent unique aspects of these rights, such as specific geographical locations or particular mining operations. This uniqueness is essential for ensuring that each tokenized asset maintains its distinct value and characteristics.

- ERC-20 Tokens: ERC-20 is a standard used for creating fungible tokens on the Ethereum blockchain. These tokens are interchangeable and hold the same value, making them suitable for representing shares in gold mining rights where each share is equal in value and rights. ERC-20 tokens are widely used due to their compatibility with a broad range of wallets and exchanges, facilitating easier trading and liquidity.

Role of Smart Contracts in Tokenization

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They play a crucial role in the tokenization process by automating various aspects of the transaction and management of tokens.

In gold mine tokenization, smart contracts are used to:

- Automate Transactions: Smart contracts automatically execute transactions when certain predefined conditions are met, such as the transfer of tokens between parties.

- Distribute Rights and Dividends: If the gold mining operation generates profits, smart contracts can be programmed to automatically distribute dividends to token holders based on their ownership stake.

- Ensure Compliance: Smart contracts can be designed to enforce regulatory compliance, ensuring that only eligible investors can purchase tokens and that all transactions adhere to legal requirements.

- Manage Token Lifecycle: From issuing new tokens to handling redemption or expiry, smart contracts manage the entire lifecycle of a token, ensuring efficiency and adherence to the predefined rules.

By leveraging smart contracts, the tokenization process becomes more secure, transparent, and efficient, reducing the need for intermediaries and lowering transaction costs. This automation and programmability are key to enabling a dynamic and responsive system for tokenized gold mining rights.

Financial and Legal Considerations

Transaction Fees and Royalty Structures

The financial framework of tokenized gold mines includes specific considerations regarding transaction fees and royalty structures, which are vital for the economic sustainability of such projects.

- Transaction Fees: In tokenized gold mine projects, transaction fees are often levied on the sale and purchase of tokens. These fees are typically a percentage of the transaction value and are used to cover the costs of maintaining the blockchain system, ensuring security, and providing ongoing support and development. For instance, in the case of Santo Mining Corp’s partnership with Vegachi Holdings SAS, a 3% transaction fee is charged for the sale of each NFT, which includes the costs associated with the minting and transferring of tokens.

- Royalty Structures: Royalty fees are another financial aspect, often incorporated in the tokenization model. These fees are a form of ongoing revenue for the token issuers and are charged as a percentage of the profits or revenues generated from the gold mining operations. The royalty structure incentivizes the continuous development and maintenance of the tokenized asset. For example, Santo Mining Corp receives a 1.5% royalty fee for every future transaction of the minted NFTs.

Legal Implications and Regulatory Compliance

The legal landscape for tokenized gold mines is complex and varies by jurisdiction. It involves several key considerations:

- Securities Law Compliance: Tokenized assets, depending on their structure, may be classified as securities under various jurisdictions. This classification requires compliance with securities regulations, including registration, disclosure, and investor protection measures.

- Property Rights and Ownership: Legally defining the ownership rights represented by digital tokens is crucial. This involves ensuring that the tokens accurately reflect the underlying gold mining rights and that these rights are legally enforceable.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Token issuers must adhere to AML and KYC regulations to prevent illegal financial activities. This involves verifying the identity of investors and monitoring transactions for suspicious activities.

- Cross-border Considerations: Given the global nature of blockchain and digital assets, cross-border legal considerations are crucial. Token issuers must navigate the legal frameworks of different countries, especially when allowing international investors to participate.

- Smart Contract Legalities: The legality of smart contracts must be established, ensuring that they are recognized and enforceable under relevant legal systems. This also involves addressing any legal issues that may arise from the automated nature of these contracts.

- Regulatory Evolution: The legal framework surrounding tokenization and blockchain is continually evolving. Staying abreast of regulatory changes and adapting to new legal requirements is essential for the ongoing viability of tokenized gold mine projects.

Navigating these financial and legal complexities is critical for the successful implementation and sustained operation of tokenized gold mines. It requires a multidisciplinary approach, combining expertise in finance, law, and blockchain technology.

Market Impact and Investor Benefits

Market Valuation and Growth of Tokenized Gold

The market impact of tokenizing gold, particularly in the context of gold mines, has been significant, with the value of the tokenized gold market surpassing $1 billion. This growth reflects an increasing recognition of the benefits of blockchain technology in asset tokenization and a shift in investor interest towards more innovative and accessible forms of investment.

Tokenized gold brings a modern twist to one of the world’s oldest assets, combining the inherent value of gold with the efficiency and flexibility of digital assets. This combination is attracting both traditional gold investors and new market participants, contributing to the overall growth of the digital asset sector.

The valuation of tokenized gold is directly linked to the value of the physical gold it represents, ensuring that investors are exposed to the actual gold market dynamics. This linkage helps maintain the intrinsic value of the tokens while leveraging the benefits of blockchain technology for enhanced trading and investment opportunities.

Advantages for Investors: Accessibility, Liquidity, and Fractional Ownership

Tokenization of gold mines offers several key advantages to investors, making it an attractive option for a wide range of market participants:

- Accessibility: Tokenization lowers the entry barriers for investing in gold mines. By fractionalizing the investment, it allows individuals and small-scale investors to participate in gold mining ventures, which were traditionally reserved for large investors or specialized investment groups. This inclusivity broadens the investor base and democratizes access to this lucrative market.

- Liquidity: Digital tokens representing gold mining rights or gold itself can be easily traded on various exchanges, providing higher liquidity compared to traditional forms of gold investment. This liquidity is a significant advantage for investors who seek to quickly enter or exit positions based on market conditions.

- Fractional Ownership: The concept of fractional ownership is central to tokenization. Investors can purchase tokens that represent a small part of the gold mine or the gold extracted, which means they can invest according to their budget without needing to buy a full share or a large quantity of physical gold. This fractionalization not only makes the investment more accessible but also allows for a more diversified investment portfolio.

- Transparency and Security: The use of blockchain technology ensures a high level of transparency in transactions and ownership records. Moreover, the immutable nature of the blockchain ledger enhances the security of investments, reducing the risk of fraud and mismanagement.

- Real-Time Trading: Unlike traditional gold investments that may have time-bound trading constraints, tokenized gold can be traded round the clock, providing investors with the flexibility to respond to market movements in real time.

The integration of tokenized gold into the market is creating a more dynamic, inclusive, and efficient investment landscape. As the technology and regulatory frameworks continue to evolve, the market for tokenized gold, particularly from gold mines, is poised for further growth, offering an array of opportunities for both seasoned and new investors.

Challenges and Risks

Addressing Security Concerns

While the tokenization of gold mines offers numerous advantages, it also brings certain challenges and risks, particularly in terms of security. The primary security concerns revolve around the digital nature of tokens and the use of blockchain technology.

- Cybersecurity Risks: Digital tokens are susceptible to various forms of cyber-attacks, including hacking and phishing scams. Protecting these assets requires robust cybersecurity measures, including secure encryption methods, multi-factor authentication, and continuous monitoring of the network for any unauthorized activities.

- Smart Contract Vulnerabilities: Smart contracts automate many processes in tokenization but can be vulnerable to bugs and errors. Ensuring the security and reliability of these contracts necessitates thorough testing, auditing, and the implementation of fail-safes to prevent exploitation.

- Regulatory Compliance Risks: Compliance with evolving regulatory standards, particularly concerning anti-money laundering (AML) and know your customer (KYC) regulations, is crucial. Non-compliance can lead to legal issues and undermine investor confidence.

- Blockchain Network Security: While blockchain is inherently secure, it is not immune to risks such as the 51% attack, where a user or group gains control of the majority of the network’s mining power, potentially disrupting the network operations. Ensuring network security and decentralization is key to mitigating such risks.

Risks of Scarcity Value and Asset Linkage

- Scarcity Value Risks: One of the unique challenges in tokenizing gold mines is the risk associated with the scarcity value of gold. If a substantial amount of gold were to be tokenized at once, it could impact the market price of gold, potentially leading to volatility and uncertainty. Careful management of the amount of gold being tokenized is essential to maintaining market stability.

- Asset Linkage Concerns: There is a risk involved in ensuring that the token remains accurately linked to the underlying physical asset. For instance, if a fraction of gold in a vault is stolen or misplaced, it could impact the value of the tokens linked to that gold. Establishing and maintaining a reliable and verifiable link between the digital tokens and the physical gold is crucial to preserving the integrity and trust in the tokenization system.

- Operational Risks: The process of tokenization involves various operational aspects, from mining to token issuance and management. Operational risks, such as inefficiencies in mining operations or issues in the token issuance process, can impact the value and reliability of the tokens.

- Market Acceptance and Adoption: The concept of tokenizing gold mines is relatively new, and there may be challenges related to market acceptance and adoption. Building trust among investors and ensuring widespread understanding and acceptance of this new form of investment is crucial for the long-term success of tokenized gold mines.

Addressing these challenges and risks is vital for the growth and stability of the tokenized gold mine market. It requires a concerted effort from industry players, regulators, and technology experts to develop robust solutions and frameworks that ensure security, compliance, and trust in the system.

Regulatory Challenges and Future Prospects

Current Regulatory Landscape

The regulatory landscape for tokenized gold mines is an evolving and complex area, marked by a blend of opportunities and challenges. Key aspects include:

- Securities Regulations: Many jurisdictions may classify tokenized assets as securities, subjecting them to specific regulatory requirements. These regulations can involve registration, reporting, and compliance obligations, which can be burdensome for issuers.

- Global Diversity in Regulations: There is significant variation in how different countries regulate digital assets and blockchain technology. This global diversity presents a challenge for tokenized gold mines that aim to attract international investors, as they must navigate and comply with a range of legal frameworks.

- AML and KYC Compliance: Anti-money laundering and know-your-customer standards are critical in the digital asset space. Token issuers must implement robust systems to verify investor identities and track transactions to prevent illicit activities.

- Taxation and Reporting: The tax implications of trading and owning digital tokens are still being defined in many regions. Token issuers and investors must stay informed about tax obligations and reporting requirements in various jurisdictions.

- Emerging Regulations: As tokenization is a relatively new field, many regulatory bodies are still developing guidelines and laws to govern it. This evolving regulatory environment requires constant vigilance and adaptability from participants in the tokenized gold market.

Future Trends and Potential Developments in Tokenization

Looking ahead, the future of tokenized gold mines is likely to be shaped by several trends and potential developments:

- Increased Regulatory Clarity: As governments and financial authorities become more familiar with blockchain and tokenization, clearer and more standardized regulations are expected to emerge. This clarity will likely foster greater confidence and participation in the market.

- Technological Advancements: Continuous advancements in blockchain technology will enhance the efficiency, security, and scalability of tokenization platforms. These improvements could open up new possibilities for tokenizing gold mines and other assets.

- Integration with Traditional Finance: Tokenized assets are increasingly being recognized and integrated into traditional financial systems. This integration could include listing tokenized gold on mainstream financial exchanges and developing new financial products based on tokenized assets.

- Growth in Decentralized Finance (DeFi): The integration of tokenized gold mines with DeFi platforms could lead to innovative financial services and investment products, further enhancing liquidity and investment opportunities.

- Broader Market Adoption: As understanding and trust in tokenization grow, a broader range of investors – from retail to institutional – may enter the market, expanding the capital base and liquidity of tokenized gold assets.

- Focus on ESG Compliance: Tokenization can play a role in enhancing transparency and accountability in gold mining practices, aligning with Environmental, Social, and Governance (ESG) standards. This alignment could attract a new segment of socially conscious investors.

In conclusion, while regulatory challenges currently pose hurdles for the tokenization of gold mines, the sector is poised for significant growth and transformation. As regulations become more defined and technology continues to advance, the potential for tokenized gold mines to reshape the investment landscape and contribute to a more inclusive and efficient financial system is immense.

Conclusion

Summarizing the Potential of Gold Mine Tokenization

The journey of tokenizing gold mines marks a significant convergence between traditional asset classes and innovative blockchain technology. This fusion has the potential to transform the gold mining industry by introducing new levels of accessibility, transparency, and efficiency. Key takeaways include:

- Democratization of Investment: Tokenization lowers entry barriers, enabling a broader range of investors to participate in gold mining ventures. This democratization not only diversifies the investor base but also injects new capital into the industry.

- Enhanced Liquidity and Accessibility: The tokenization of gold mines provides investors with enhanced liquidity and the flexibility of digital asset trading, making it easier to buy, sell, and manage investments.

- Transparency and Security: Blockchain technology ensures a high level of transparency and security in transactions, fostering trust among investors and stakeholders in the gold mining sector.

- Innovative Investment Opportunities: Tokenization opens up innovative investment opportunities, including fractional ownership and integration with decentralized finance platforms, offering new ways for investors to engage with gold mining.

Future Outlook for Blockchain in the Gold Mining Industry

Looking ahead, the future of blockchain in the gold mining industry is bright and holds immense potential:

- Technological Advancements: Ongoing advancements in blockchain technology will likely lead to more efficient, secure, and user-friendly tokenization platforms, further boosting investor confidence and market participation.

- Regulatory Evolution: As regulatory frameworks around digital assets continue to evolve, clearer and more supportive regulations are expected to emerge, providing a more stable and predictable environment for tokenized gold mines.

- Integration with Traditional Markets: The integration of tokenized gold with traditional financial markets could lead to broader acceptance and recognition, potentially making tokenized gold a mainstream investment option.

- Sustainable and Ethical Mining Practices: Blockchain’s ability to track and verify ethical mining practices aligns with growing investor interest in ESG-compliant investments, potentially attracting a new wave of socially responsible investments in the gold mining sector.

- Global Adoption and Innovation: As the concept gains global traction, we can expect to see more innovative applications of blockchain in gold mining, ranging from supply chain management to new financial products.

In conclusion, the tokenization of gold mines, driven by blockchain technology, is not just a fleeting trend but a pivotal development with far-reaching implications. It promises to reshape the gold mining industry, making it more inclusive, transparent, and aligned with the digital age. As the industry navigates through the challenges and harnesses the opportunities presented by this technology, the future of gold mining looks more dynamic and promising than ever before.