Restifi Marketplace:

- Cashflow Positive Assets: The marketplace is discerningly selective, focusing exclusively on assets that generate positive cash flow, ensuring sustainable and profitable investment offerings.

- Access for Retail Investors: We provide retail investors with opportunities that were traditionally reserved for institutional investors or high-net-worth individuals, thereby democratizing access to high-caliber investment options.

Restifi Operations:

- SPV Utilization: Investments are structured using Special Purpose Vehicles (SPVs), offering a secure and transparent way to hold and manage assets.

- Legal Robustness: Our operations are fortified with legal structures that comply with international standards, ensuring robustness and strict adherence to regulatory compliance.

- Asset Management: We maintain an in-house asset management team dedicated to operational transparency and efficiency, providing investors with peace of mind and trust in their investments.

Investment Process:

- Asset Selection: Our investment process is predicated on a meticulous selection of assets based on their profitability and responsiveness to market demand.

- RWA Tokenization: We specialize in the tokenization of Real World Assets (RWAs), enabling fractionalization and liquidity of assets previously illiquid.

- Investment Democratization: Our platform facilitates a more inclusive investment landscape, allowing a wider investor demographic to participate in opportunities previously out of reach.

Revenue and Growth:

- Revenue Generation: Through a carefully curated selection of tokenized assets, we generate robust revenue streams for our investors.

- Growth Strategy: Our growth strategy is centered around continuous asset evaluation and alignment with market movements to capitalize on opportunities for expansion and investor returns.

Legal and Compliance:

- Regulatory Compliance: We ensure that all operations are in strict compliance with relevant tax laws and regulatory frameworks.

- Governance Structure: The governance of our platform is supported by legal advisory, ensuring decisions are made with due diligence and legal foresight.

Market Presence:

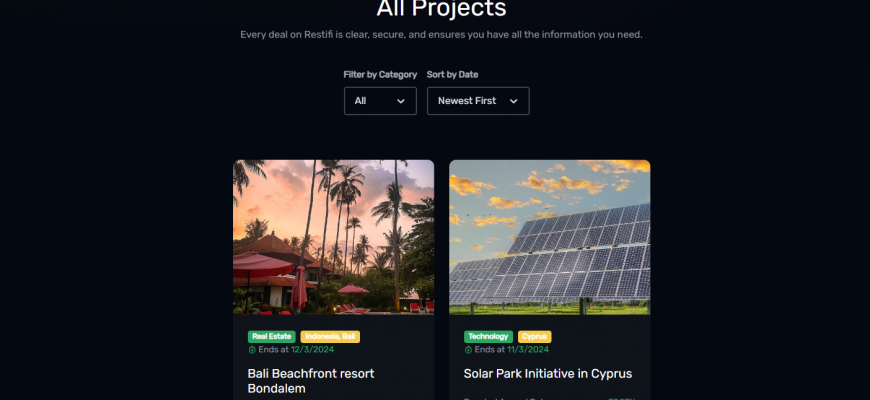

- Robust Marketplace: We have established a dynamic marketplace for asset trading, which stands as a testament to our market presence and investor trust.

- Diversified Assets: Our portfolio features a diverse range of assets, enhancing the investment options available to our clients, catering to varied investment preferences and risk appetites.

Community Engagement:

- Active Engagement: Our community engagement initiatives are robust, utilizing platforms to foster a sense of community among investors.

- Transparent Communication: We believe in transparent communication channels to encourage active participation and valuable contributions from our community members.

Auditing and Due Diligence:

- Due Diligence: Each asset undergoes comprehensive due diligence before tokenization, ensuring that our investors’ interests are safeguarded.

- Audit Reviews: We conduct regular audit reviews to monitor asset performance, ensuring ongoing compliance and maintaining investor confidence.

Platform Technology:

- Blockchain Integration: Our platform is built on the bedrock of blockchain technology, which provides a secure and transparent framework for all transactions.

- Intuitive Interface: We offer our investors a clear and user-friendly interface for managing their assets, simplifying the investment process without compromising on sophistication or control.