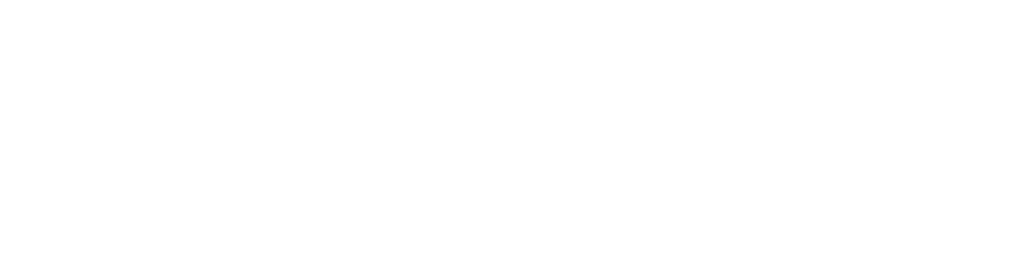

Restifi stands at the forefront of financial innovation, blending the timeless allure of traditional investments with the cutting-edge potential of blockchain technology. Our platform is more than a marketplace; it’s a sophisticated ecosystem designed to transform illiquid assets into tradable tokens, opening new horizons for asset owners and investors alike.

Diverse Jurisdictional Expertise: At Restifi, we navigate the complex web of global regulations with agility and precision. Our operational framework spans several jurisdictions, including the strategic stability of Switzerland, the favorable investment climate of the British Virgin Islands (BVI), and the progressive environment of Wyoming DAO LLCs. The choice of jurisdiction is a meticulous process, influenced by factors such as the asset type, target investor demographics, tax implications, and regulatory landscapes. Our goal is to leverage each jurisdiction’s unique advantages to optimize asset tokenization’s legal and financial efficacy.

Legal and Compliance Rigor: Our collaboration with seasoned law firms ensures that compliance and taxation are not just afterthoughts but integral parts of our operational ethos. From the intricate details of SPV structuring to the nuanced requirements of international tax laws, our legal partners provide the expertise necessary to maintain the highest standards of regulatory adherence and fiscal responsibility.

Tokenization as a Gateway to Liquidity: Restifi empowers asset owners to ‘unchain’ the value tied up in high-worth investments. Through tokenization, we convert equity, bonds, and even precious commodities like gold into digital tokens. This process is not only a technological marvel but a strategic redefinition of asset liquidity.

Case Studies in Tokenization:

- Tokenized Equity: Unlock shareholder value by dividing equity into tokens, providing investors with flexible entry points into ownership and participation in company growth.

- Tokenized Bonds: Transform debt instruments into digital tokens, allowing for fractional ownership of debt securities, which opens up the bond market to a broader investor base.

- Tokenized Gold: Leverage the intrinsic value of gold while providing the ease of digital asset trading, merging the stability of precious metals with the liquidity of the digital age.

A Paradigm Shift in Investment Strategy

The philosophy guiding Restifi is one of democratization and accessibility. By providing a tokenization platform, we are not merely facilitating transactions; we are pioneering a shift towards a more inclusive financial ecosystem. We believe in the transformative power of tokenization to enhance liquidity, diversify investment opportunities, and bring transparency to the investment process.

Our expertise extends beyond the mechanics of blockchain to encompass a holistic understanding of the investment lifecycle. We engage with our community through educational initiatives, insightful market analyses, and robust support systems, ensuring our users are well-equipped to make informed decisions.

Restifi’s commitment to excellence is reflected in our rigorous asset curation process, where every potential investment undergoes a comprehensive evaluation. We look at market trends, asset performance, and future potential to present our investors with opportunities that meet our high standards.

Join the Tokenization Revolution with Restifi

As we continue to expand our portfolio of tokenized assets, we invite progressive investors and asset owners to explore the benefits of our platform. Whether it’s turning a piece of art into a shareable digital asset or offering a slice of real estate to the global market, Restifi is your partner in unlocking the true potential of your investments.

Step into the future with Restifi, where your assets are not just stored value but active participants in the world’s financial markets.